Therefore, after all, peer-to-fellow credit is pretty simpler in order to each other people and consumers. The only real issue is, the new accompanying yearly interest rates can also be extend to thirty-six% to possess bad credit money.

If you don’t, you should be able to utilize money for almost something along with advantage buy, business, debt consolidating, etcetera.

Borrowing from the bank Relationship Loans

The brand new You.S. currently servers more than 5,eight hundred credit unions, and that suffice all sorts of communities regarding local teams so you’re able to elite group communities and you can appeal communities. He could be broadening ever more popular one of consumers due to the fact, in the place of banks, borrowing unions give most versatile loan conditions.

Some, as an instance, allow their participants so you can conveniently get a loan with poor credit. They http://www.paydayloancolorado.net/crested-butte/ just remark your application based on their profile, subscription level, and maybe the fresh projected payment plan.

The advantages cannot hold on there, regardless if. For people who go for a federal borrowing union mortgage, it is possible to see that this new Annual percentage rate (APR) maxes out within 18%. That is according to National Borrowing Union Management (NCUA), whose data at the same time urban centers the average Apr having a good about three-season government borrowing from the bank relationship mortgage during the 8.86%. Financial institutions, at exactly the same time, charge the average rate off nine.98% over the exact same months.

Which explains as to the reasons borrowing partnership money throughout the You.S. features nearly doubled into the really worth within half a dozen age away from $660 billion during the 2013 so you’re able to $step one.19 trillion when you look at the 2020.

Pay day loan Software

Pay day loan software eg Dave, Brigit and you may MoneyLion should be a terrific way to let connection the fresh pit anywhere between paydays. In place of depending on your credit report particularly loan providers would, cash advance applications make use of financial records to decide the qualifications. Nonetheless they charge somewhat lower mortgage cost than simply payday loan loan providers. Some charges zero interest or later costs at all.

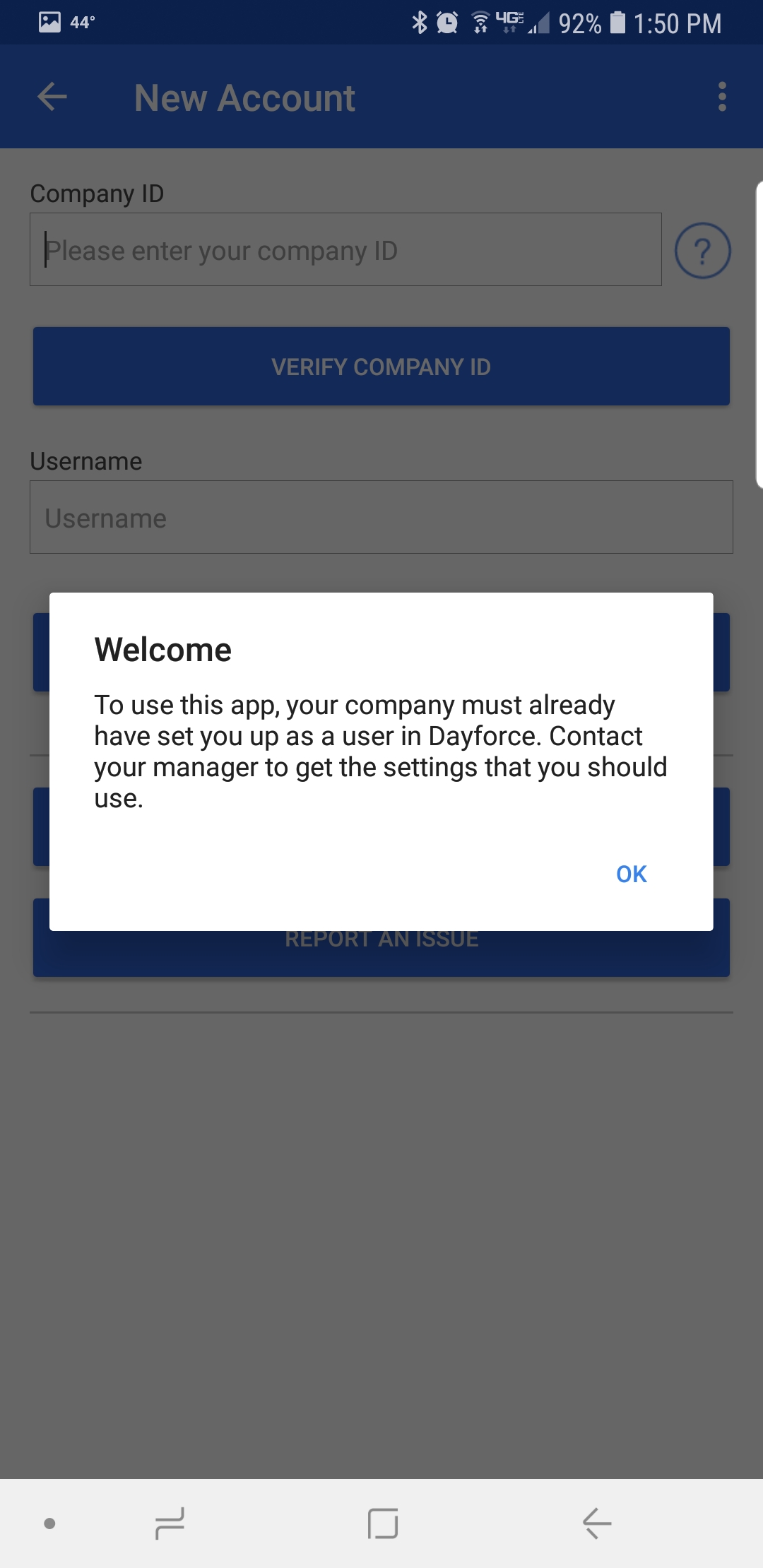

This is how it really works: After you down load the software to the smart phone, give it accessibility your money. Extremely software do this through Plaid to assist manage your data. When your checking account is connected, this new software uses an algorithm to analyze their put and using interest to ensure that you meet with the app’s financing conditions.

Really pay day loan programs just promote really small money to help you the users. Extremely common to only feel recognized for $30-$fifty while the a separate member. You happen to be needed to link a bank checking account and set right up autopay. Because you obtain and you can pay their advances, but not, you might increase the amount of money you might be capable to use.

House equity finance and you can personal lines of credit will let you borrow from the collateral you collected of your home.

Equity ‘s the difference between exactly what your domestic will sell getting with the the current business and exactly how far you will still owe on the home loan. Such as for instance, when your home is already cherished during the $550,000 and you however are obligated to pay $225,000 on your own financial, there’ll be gathered $225,one hundred thousand inside equity.

A home security loan feels as though most other money. Your get a certain amount and you will, if recognized, you obtain extent in one single lump deposit. Then chances are you pay-off the loan as you carry out other financing.

A house collateral line of credit is much more such as for example which have a mastercard. Your guarantee is the credit limit. In place of financing, youre usually provided a credit to use for purchases. Your instalments was used in the same way they might end up being that have other credit card – because you pay off your own balances, your own borrowing limit expands.

Payday loans

Cash advance are made to target individuals having bad credit. They are an urgent situation mortgage your always needed to pay back on their pay check.